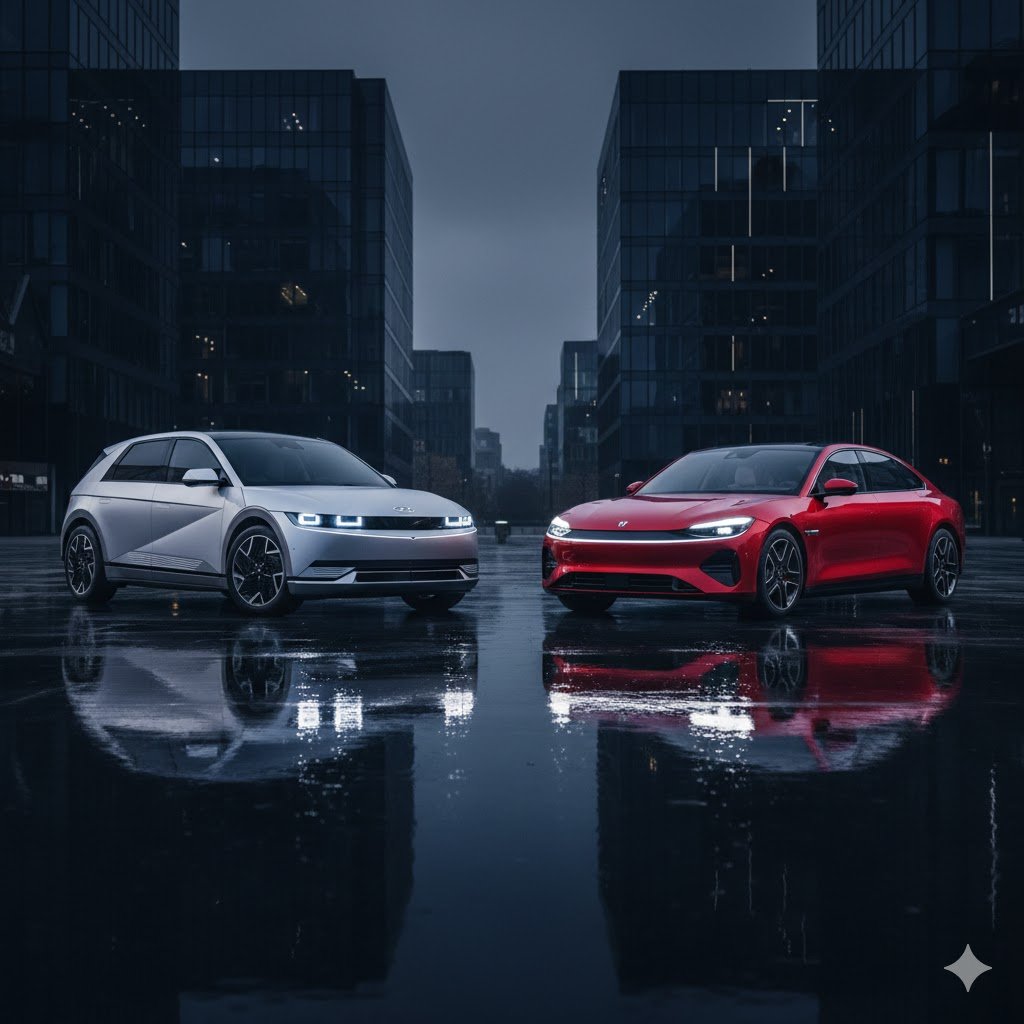

The global automotive landscape is undergoing its most significant transformation since the invention of the assembly line. At the heart of this revolution is the race for Electric Vehicle (EV) supremacy. While Western legacy automakers are racing to catch up, two Asian powerhouses—South Korea and China—have emerged as the definitive leaders in the “post-internal combustion” era.

While both regions dominate the market, they represent two very different philosophies regarding technology, manufacturing, and global branding.

1. Manufacturing Philosophy: Precision vs. Scale

South Korea (Hyundai Motor Group): The Korean approach, led by Hyundai and Kia, is rooted in high-end engineering and “lifestyle” integration. They have focused on the E-GMP (Electric-Global Modular Platform), which allows for ultra-fast 800V charging—a feature usually reserved for high-end luxury cars like Porsche. Korean EVs are designed to feel like a premium evolution of the traditional car, focusing on tactile quality and driver ergonomics.

China (BYD, NIO, XPeng, Zeekr): China’s strength lies in unparalleled vertical integration and scale. Companies like BYD started as battery manufacturers, meaning they control the most expensive part of the supply chain. This allows them to produce EVs at a price point that competitors struggle to match. While Korea focuses on a few high-quality “hits,” Chinese manufacturers flood the market with a massive variety of models, from $10,000 city cars to high-end luxury SUVs.

2. Battery Technology: Chemistry and Innovation

The battle of the batteries is where the two regions diverge most sharply:

- South Korea is the champion of NCM (Nickel Cobalt Manganese) batteries. These offer higher energy density and longer range, making them ideal for the high-performance and long-distance driving preferred in Western markets.

- China has pioneered the resurgence of LFP (Lithium Iron Phosphate) batteries. While they typically offer slightly less range, they are significantly cheaper, safer, and have longer lifespans. China’s dominance in LFP technology is the primary reason they can offer EVs for under $20,000.

3. Software and “Smart” Features

China is currently leading the world in the “Software-Defined Vehicle” concept. For Chinese consumers, an EV is a “smartphone on wheels.” Brands like NIO and XPeng offer advanced voice assistants, in-car gaming, and sophisticated autonomous driving features that often surpass what is available in Korean models.

Korea, however, excels in integrated hardware software. Their focus is on efficiency—specifically, class-leading aerodynamics and power management that ensures the “estimated range” on the dashboard is actually achievable in the real world.

4. Global Market Positioning

The Korean Advantage: South Korea enjoys strong geopolitical stability and established dealership networks in the US and Europe. Because they comply with many local subsidy requirements (like the US Inflation Reduction Act), they remain the primary choice for Western buyers looking for a non-Tesla EV.

The Chinese Challenge: Chinese brands face significant hurdles in the form of import tariffs and data privacy concerns in the West. However, they are rapidly conquering Southeast Asia, South America, and the Middle East, where price sensitivity is higher and brand loyalty to “legacy” makers is lower.

Conclusion

The “Showdown” isn’t necessarily about one winning and the other losing. Instead, we are seeing a market split: South Korea is winning the premium-mainstream segment by offering high-tech, fast-charging, and beautifully designed vehicles for the global middle class. China is winning the race to mass adoption, proving that EVs can be affordable, tech-forward, and produced at a scale the world has never seen before.